April 9, 2025

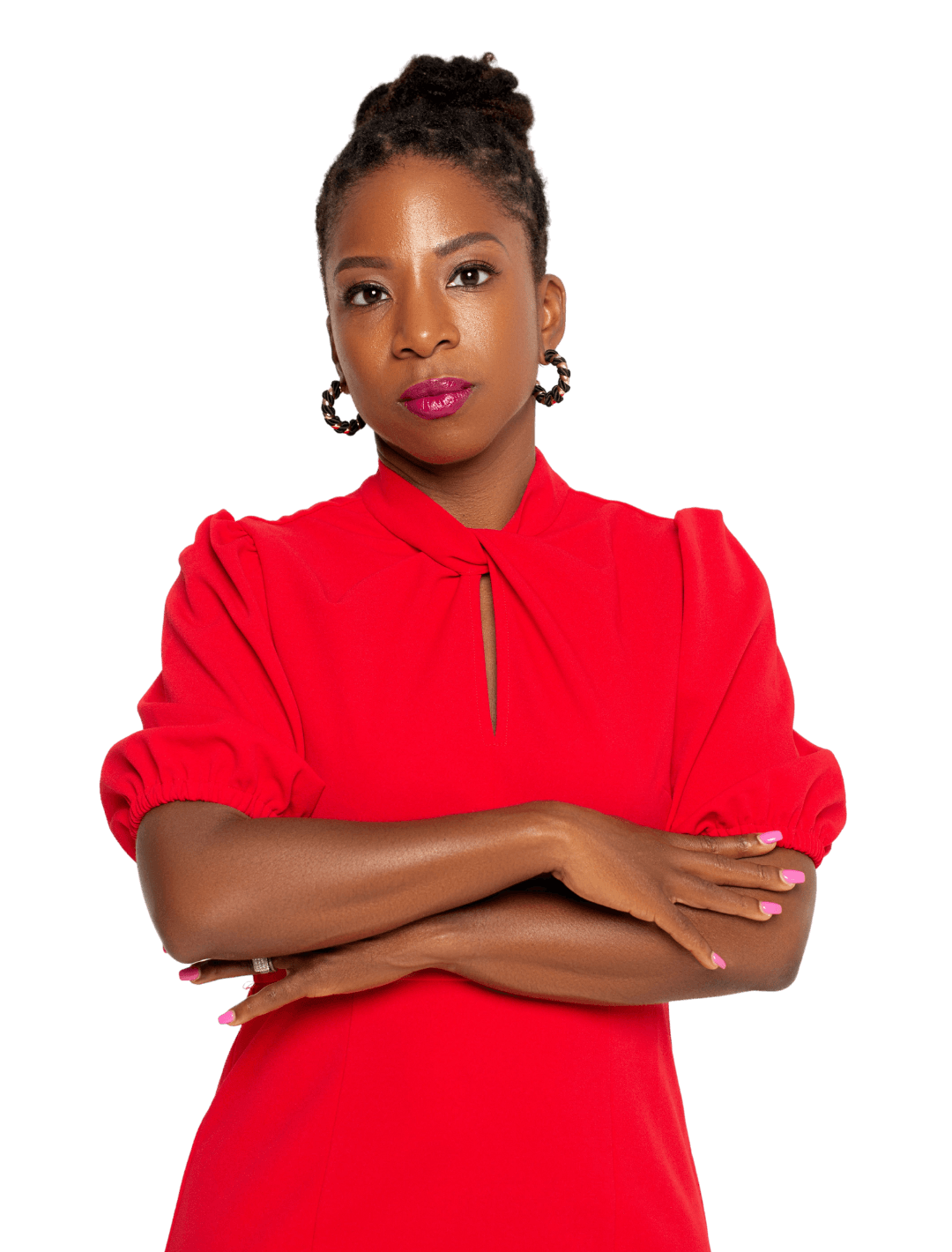

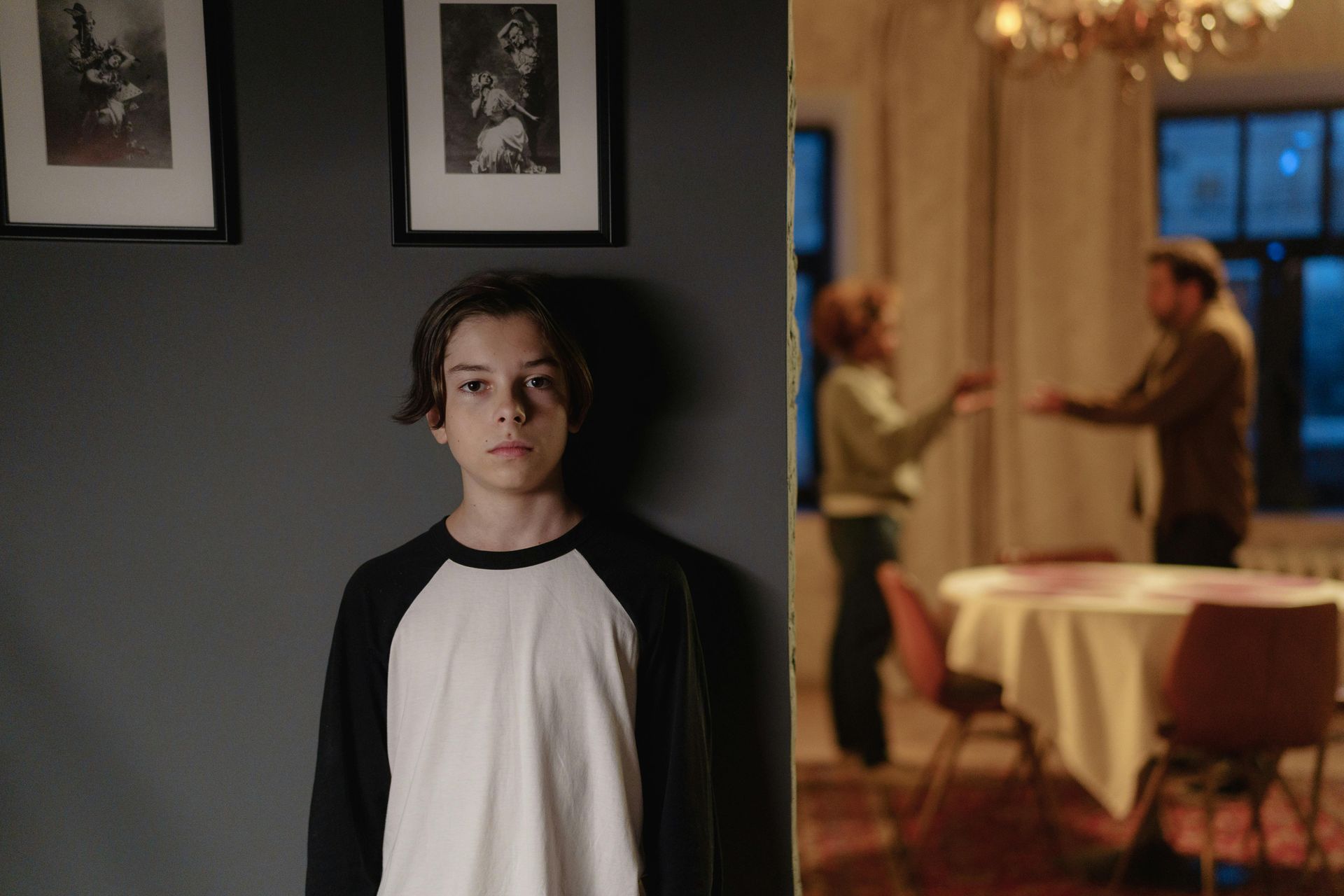

Family structures in South Florida today are wonderfully diverse. Increasingly, children are born to parents who are not married. While the bond between a parent and child is profound regardless of marital status, the legal landscape surrounding parental rights and responsibilities operates under specific rules. For children born outside of marriage in Florida, the identity of the legal father isn't automatically established, creating potential uncertainty and hindering access to crucial rights and support. This is where paternity comes into play. Establishing paternity means legally identifying the father of a child. It's a fundamental legal process with far-reaching consequences, impacting the child's financial security, emotional well-being, access to benefits, and sense of identity, while also defining the legal rights and obligations of both the mother and the father. Navigating the complexities of establishing paternity under Florida law requires knowledgeable and compassionate guidance. At The Dixon Law Firm , founding attorney Alicia Dixon is recognized as one of South Florida's most experienced Divorce, Family Law, and Paternity lawyers. She and her team understand the sensitive nature of paternity matters and are dedicated to helping parents establish legal parentage, ensuring clarity, stability, and the protection of rights for everyone involved, especially the child. This post explores why establishing paternity is so vital in Florida and outlines the significant rights and responsibilities that flow from this legal determination. What Does "Establishing Paternity" Legally Mean in Florida? In simple terms, establishing paternity is the legal process used to determine the father of a child born to unmarried parents. It's crucial to understand the distinction between being a biological father and being a legal father. While biology determines genetics, only legal paternity grants enforceable rights and imposes enforceable responsibilities under Florida law. Without legal paternity establishment: An unmarried father generally has no legal right to custody, timesharing (visitation), or decision-making regarding the child. A mother cannot legally compel the biological father to pay child support. A child has no legal right to inherit from their biological father through intestacy (dying without a will) or claim certain benefits derived from him. Florida law provides several pathways to establish legal paternity, which we will discuss later, but the core purpose remains the same: to legally confirm the identity of the child's father. Why Establishing Paternity is Crucial: The Child's Best Interests Above all, establishing paternity serves the best interests of the child. It provides a foundation of security and opens doors to resources and connections that every child deserves. Key benefits for the child include: Financial Security: A child has the right to be financially supported by both legal parents. Establishing paternity is the necessary first step before a court can order child support payments based on Florida's Child Support Guidelines. This support is vital for meeting the child's basic needs – food, shelter, clothing, education, and healthcare. Access to Health Insurance and Medical History: Legal paternity allows the child to be covered under the father's health insurance policy, if available. Perhaps equally important, it grants access to the father's family medical history, which can be critical for diagnosing and treating potential genetic or hereditary conditions throughout the child's life. Inheritance Rights: A child legally recognized as the father's offspring has the right to inherit from their father if he dies without a will (intestate succession). Establishing paternity also ensures the child can be named as a beneficiary in the father's will or trust. They may also be able to inherit from paternal grandparents or other relatives. Eligibility for Government and Other Benefits: Paternity establishment makes a child eligible for various potential benefits derived through the father, such as: Social Security survivor benefits if the father passes away. Social Security disability benefits if the father becomes disabled. Military or veteran's benefits (if applicable). Potential wrongful death claims or settlements. Emotional Well-being and Sense of Identity: Knowing both parents contributes significantly to a child's sense of self, belonging, and emotional stability. Establishing paternity provides answers, eliminates uncertainty, and fosters a connection to the father's side of the family, culture, and heritage. Foundation for a Relationship: Legal paternity provides the necessary legal framework upon which a meaningful parent-child relationship can be built and protected through court-ordered timesharing and parental responsibility arrangements. Rights and Responsibilities That Arise for the Mother When paternity is legally established, the mother gains certain enforceable rights and also confirms her parental responsibilities within a legal framework involving the father: Right to Seek Child Support: The mother can petition the court to order the legal father to pay child support according to state guidelines, ensuring he contributes financially to the child's upbringing. Right to Establish a Parenting Plan/Timesharing Schedule: She can request a formal, court-ordered parenting plan that outlines custody, timesharing schedules, and how major decisions about the child will be made. This provides structure and predictability. Right to Access Father's Medical History: She can obtain potentially vital family medical history information from the father for the child's health and well-being. Shared Parental Responsibility: Unless sole parental responsibility is awarded (which is rare), she will typically share the rights and responsibilities of parenting with the legal father, requiring communication and cooperation as outlined by law and court orders. Rights and Responsibilities That Arise for the Father For unmarried biological fathers in Florida, establishing legal paternity is the only way to secure enforceable parental rights. Until paternity is legally established, a biological father has virtually no legal standing regarding the child. Establishment grants significant rights but also imposes important duties: Right to Timesharing (Custody/Visitation): This is often the most sought-after right. Once paternity is established, a father can petition the court for a timesharing schedule, allowing him meaningful involvement in his child's life. Florida law presumes shared parental responsibility and frequent contact with both parents is in the child's best interest, unless proven otherwise. Right to Shared Parental Responsibility: Legal fathers typically gain the right to participate in major decisions concerning the child's upbringing, including education, healthcare, and religious instruction, often shared jointly with the mother. Right to Be Notified/Contest Adoption: A legal father must be notified if someone else attempts to adopt his child, and he has the legal standing to contest the adoption. Responsibility for Financial Support: The most significant responsibility is the legal obligation to financially support the child through court-ordered child support payments. Responsibility for Health Insurance: The father may be ordered to provide health insurance coverage for the child if it is reasonably available. Responsibility to Follow Court Orders: The father must adhere to the terms of the parenting plan, timesharing schedule, and any other court orders related to the child. How is Paternity Legally Established in South Florida? Florida Statutes Chapter 742 governs the establishment of paternity. There are several primary methods: Voluntary Acknowledgment of Paternity (VAP): This is the simplest method, often done at the hospital shortly after birth. Both the mother and the man acknowledging fatherhood sign a specific legal form (DH-511) under oath. This form, once properly filed, legally establishes paternity and has the same effect as a court order. Caution: While simple, signing a VAP should only be done if both parties are certain about paternity. There is only a very short window (60 days) to rescind (cancel) the acknowledgment. After that, challenging it becomes much more difficult and requires proving fraud, duress, or material mistake of fact. It's crucial not to sign if there is any doubt – genetic testing should be pursued first. Legitimation by Marriage: If the parents marry each other after the child is born, they can take steps to have the child legally recognized as a child born "of the marriage," effectively establishing paternity, often involving updating the child's birth certificate. Administrative Order: Paternity can sometimes be established through an administrative process initiated by the Florida Department of Revenue, usually when they are involved in enforcing child support. This process may also involve genetic testing. Court Order: This is the most formal method and often necessary when parents disagree, when one party is uncooperative, or when issues beyond just parentage (like timesharing and child support) need simultaneous resolution. A "Petition to Establish Paternity" is filed with the Circuit Court in the appropriate county in South Florida. Who can file? The mother, the man seeking to establish his paternity, or the child (through a legal representative) can file the petition. Process: The petition is filed and legally served on the other party. If paternity is contested, the court will typically order scientific genetic (DNA) testing . Florida law creates a strong legal presumption of paternity if the test results show a 95% or higher probability. Comprehensive Resolution: A court action addresses not only paternity but also establishes child support obligations (retroactive and ongoing), creates a detailed Parenting Plan outlining parental responsibility and a timesharing schedule, and addresses health insurance coverage and name changes if requested. This comprehensive approach provides clarity and legally enforceable orders covering all key aspects. When is Legal Action Necessary? While VAPs are common, court action is often required in situations such as: The alleged father denies paternity or refuses to sign a VAP. The mother is unsure who the father is or refuses to name him. An unmarried father wants to establish legally enforceable timesharing rights. A mother needs to secure court-ordered child support. Genetic testing is needed to confirm parentage definitively. Complex issues regarding parental responsibility or relocation need to be addressed. The Crucial Role of Experienced Legal Counsel: The Dixon Law Firm Navigating Florida's paternity laws and court procedures can be overwhelming, especially when emotions are running high. Having an experienced South Florida paternity lawyer like Alicia Dixon on your side is invaluable. The Dixon Law Firm provides essential support by: Explaining Your Rights and Options: Clearly outlining the different paths to establishing paternity and the implications of each. Filing Necessary Court Documents: Properly drafting and filing Petitions to Establish Paternity and other required legal paperwork. Navigating Genetic Testing: Assisting with the process of court-ordered DNA testing and interpreting the results. Representing You in Court: Advocating for your interests in hearings before judges regarding paternity, child support, timesharing, and parental responsibility. Negotiating Agreements: Skillfully negotiating comprehensive Parenting Plans and child support arrangements that are fair and in the child's best interests. Protecting Your Rights: Ensuring deadlines are met, procedures are followed correctly, and your parental rights (whether mother or father) are vigorously protected. Providing Objective Guidance: Offering clear-headed advice during an often emotional process. Alicia Dixon's deep experience specifically within the South Florida family court system ensures knowledgeable and effective representation tailored to the local legal landscape. Conclusion: Securing Clarity and Stability for the Future Establishing legal paternity is far more than just naming a father on a birth certificate. It's a foundational legal step that provides profound benefits and security for the child while clearly defining the rights and responsibilities of both parents under Florida law. For unmarried fathers, it is the gateway to asserting their parental rights. For mothers, it provides the legal basis for securing necessary financial support. For children, it offers financial stability, emotional completeness, and access to critical resources. If you are an unmarried parent in South Florida facing questions about paternity, child support, or timesharing, don't navigate this complex legal terrain alone. Secure the experienced legal guidance you need to protect your rights and ensure the best possible outcome for your child. Contact The Dixon Law Firm today to schedule a consultation with Alicia Dixon . Let our experience in South Florida paternity and family law provide the clarity, support, and effective representation you need to move forward confidently. Disclaimer: This blog post is intended for informational purposes only and does not constitute legal advice or create an attorney-client relationship. 1 Paternity and family laws in Florida are complex and fact-specific. You should consult with a qualified Florida family law attorney regarding your particular situation. Contact The Dixon Law Firm for personalized legal counsel.